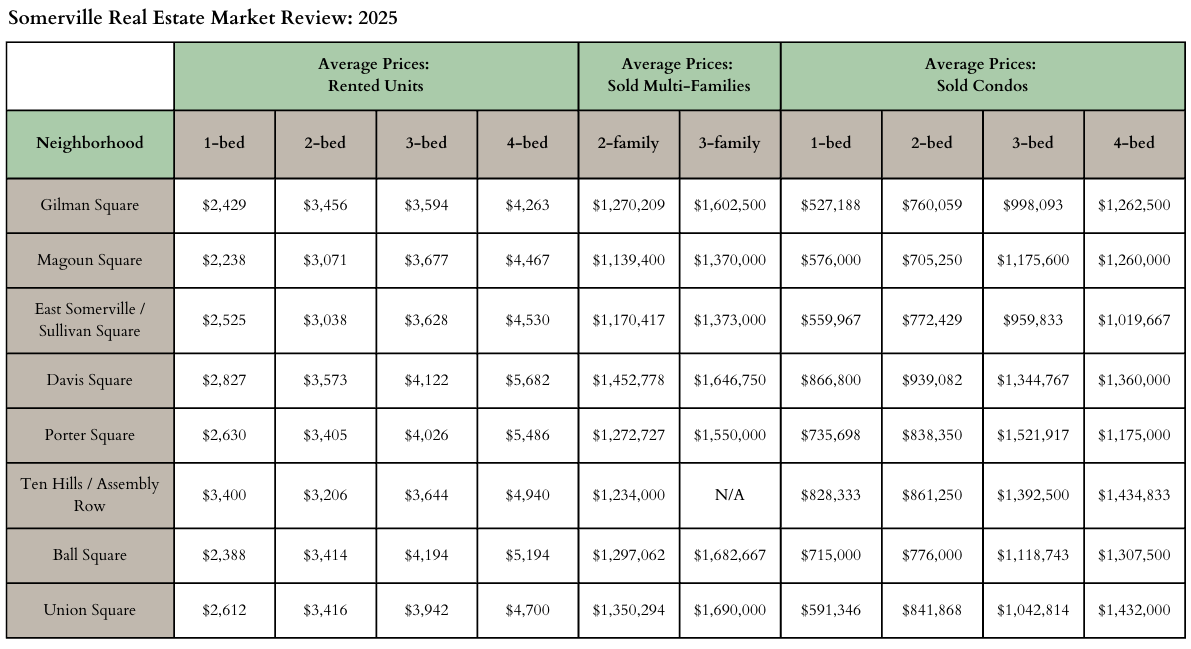

Somerville Real Estate Market Review: 2025

Introduction

As we look back on 2025, I am excited to share with you a complete breakdown of Somerville neighborhood data for:

Average rental prices for 1, 2, 3, and 4-bedroom units

Average sold prices for 2 and 3-family properties

Average sold prices for 1, 2, 3, and 4-bedroom condo

If you want to skip the high-level data summary and jump RIGHT to details on your neighborhood only, click on one of the links below:

Gilman Square ✦ Magoun Square ✦ East Somerville / Sullivan Square ✦ Davis Square

Porter Square ✦ Ten Hills / Assembly Row ✦ Ball Square ✦ Union Square

Data Summary

This data could be valuable to you in several cases:

If you’re an investor or thinking about becoming an investor, these data points will help you figure out on a high-level what you can roughly expect for rental rates in various neighborhoods based on bedroom count for rentals as well as condos. You’ll also have a better understanding of what you’ll need to pay to purchase multi-family properties.

If you are a primary buyer looking for a condo, you should have a pretty good idea of what neighborhoods are likely to be affordable for you and which ones are likely out of budget or pushing it.

When you see fields that are marked “N/A” there were not enough data points for that specific category. Generally this means there are not a lot of sales or rented units for that specific property type. This is actually valuable information, because if you are looking in a category that is marked N/A as a primary buyer, it signals it may not be easy to find or what you’re looking for may not exist at all - in other words, there’s a good chance you’ll need to adjust your search.

A few quick caveats on the data:

The data is from MLSpin. Understand that there are many rentals that happen off MLS and are not covered in this data set.

No off-market data is included.

Some fields have N/A. That means we don’t have enough data for that neighborhood/property type.

All neighborhoods boundaries were determined to the best of my ability, based on my personal opinion of the radius I consider to be relevant to a particular neighborhood.

After looking at this data, are you concerned your rental is underpriced or overpriced? Are you curious about selling or investing in multi-families? Are you thinking of buying a condo and feel overwhelmed? Please give me a ring to discuss anytime at 617-833-7457. Read on for my thoughts and analysis.

If you want to SUBSCRIBE to future newsletters not published on my blog for Camberville/Medford hyper local real estate news/analysis, sign-up here: https://cambridge-sage.kit.com/472d081e75

Neighborhood Deep Dive

Continue reading for my thoughts on each neighborhood. If you don’t want to scroll to find the neighborhood you’re interested in, just click on one of the links below.

Gilman Square ✦ Magoun Square ✦ East Somerville / Sullivan Square ✦ Davis Square

Porter Square ✦ Ten Hills / Assembly Row ✦ Ball Square ✦ Union Square

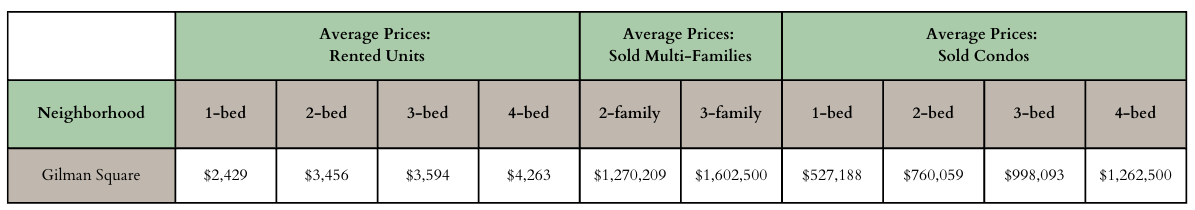

Gilman Square

I mentioned in last year's analysis that Gilman Square will continue to grow and for the most part that has held true. For rentals, 1-beds were up y-o-y about $125/mo, 2-beds were up about $200/mo, 3-beds were down slightly about $40/mo, and 4-beds were down about $140/mo.

The multi-family market in Gilman also continues to grow - 2-family sold prices are up about $50k y-o-y and 3-family sold prices are up almost $250k y-o-y.

The one area where we haven’t seen growth in Gilman is the condo market. Condo prices for 1-beds were up slightly about $20k, but 2-beds remained even year over year, 3-beds were down $80k from 2024, and 4-beds were down $90k.

My takeaways? The rental market in Gilman Square still has some serious room for growth over the next 5 to 10 years. And with rental growth comes multi-family growth too. The condo market is a big question mark - a lot of primary buyers are not ready to put roots in Gilman Square.

As Gilman Square begins to gentrify (for example when the Star Market project is completed and more retail comes to Winter Hill), I expect to see more first time home buyers flock to Gilman Square and with those first time home buyers will come more cool stuff. And with cool coffee shops, restaurants, community spaces, and so on, comes condo increases in price, but it may take a few more years before we start to see this growth coming.

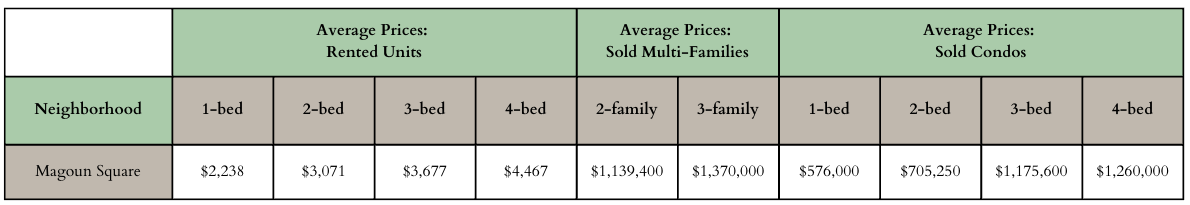

Magoun Square

Across all rental types in Magoun Square we saw a drop-off this year. 1-beds (down ~$110/mo y-o-y), 2-beds (down ~$110/mo y-o-y), 3-beds (down ~$400/mo y-o-y), and 4-beds (down ~$280/mo y-o-y). As a result of these drop-offs, we saw dropping multi-family prices in Magoun Square: 2-families were down about $100k and 3-families were down about $250k from last year’s numbers.

I see these drop-offs as temporary and I believe 2025 was a great buying opportunity for investors (in fact, I helped a few investors purchase in and around Magoun Square because the numbers were just too good to pass up). I believe in the next 5 years we will see steady growth close to Magoun Square and rental numbers will start rising again.

When it comes to condo prices in Magoun Square, we saw a mixed bag of results. 1-beds were up about $70k, 2-beds were down about $150k, 3-beds were down about $16k and 4-beds were down massively, about $200k from 2024 data.

A lot of the condo price decreases around Magoun Square are a result of luxury condos that were built in the last few years taking a hit on sales prices, as rates remained high for most of 2025. The result was that a good chunk of condo buyers got relief if they bought around Magoun Square this past year. Just as I believe rental/multi prices will rise over the long run, I believe condo prices will recover nicely long-term in Magoun Square.

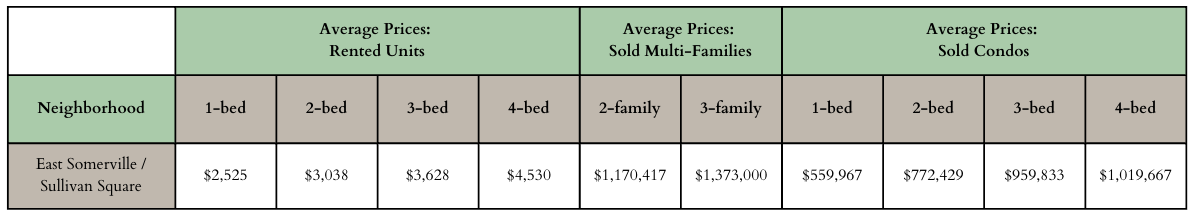

East Somerville / Sullivan Square

East Somerville rental numbers were down slightly compared to last year’s numbers across the board. 1-beds were down about $25/mo, 2-beds were down about $200/mo, 3-beds were down about $100/mo, and 4-beds were up about $100/mo. Overall I did not see a huge change for most units I worked on in East Somerville - similar tenant demographics and rental numbers stayed stagnant, but also didn’t drop-off.

I did see a reduction in multi-family sales prices in East Somerville over the last year. 2-family sold prices were down about $130k and 3-family sold prices were down about $150k. When investors tighten up their buy criteria usually the softer parts of Somerville (a bucket I would put East Somerville in) will take a hit.

However I believe that prices will rebound in 2026 - the East Somerville numbers are actually quite low compared to relatively strong East Somerville rental numbers right now, so I anticipate a slight increase upwards in sold prices for multi-families in East Somerville in 2026.

Just as we saw a downward trajectory for rentals and multi sales in East Somerville, we also saw a significant decrease in sold prices for East Somerville condos. 1-beds were down about $30k, 2-beds down about $60k, 3-beds down about $140k, and 4-bed condo sales in East Somerville were the lowest throughout Somerville in 2025 with an average sold price of $1.019M.

Because condo prices are relatively low in East Somerville right now, they look awfully attractive compared to other condo options throughout Somerville. And I anticipate first time home buyers looking for a deal and looking for more for their money, will drive demand back up in 2026.

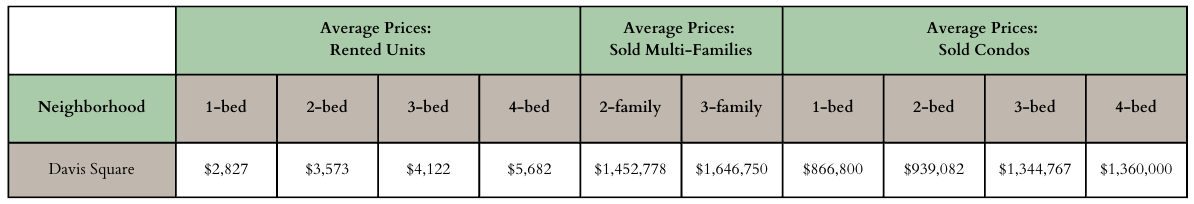

Davis Square

Davis Square on the Somerville side saw rental growth across the board compared to 2024 rental numbers. 1-beds were up about $100/mo, 2-beds were up about $250/mo, 3-beds were up even y-o-y, and 4-beds were up about $440/mo.

Multi-family sales numbers were down in Davis Square in 2025. 2-families were down about $240k and 3-families were down about $30k. Davis Square has a mix of older 2-families in poor shape and beautifully maintained Victorian 2-families that fetch a much higher sold price. I do think this data is a little misleading and while I’ve noticed perhaps a slight softening in Davis Square and a handful of Davis Square multis sitting longer than anticipated, most multis go in a weekend and many still have multiple offers, especially those properties ¼ mile or less to the heart of Davis Square.

Davis Square condo sales were a bit of a mixed bag - on the surface 1-beds look like they increased quite a bit (by over $200k from the data), but 1-bed loft spaces drove up the average sales price so I would not read too much into this increase. 2-beds remained flat, up just $3k from 2024. 3-beds were up slightly by $32k and 4-beds were down $110k. Overall the Davis Square condo market felt flat this year - on the ground I didn’t see major jumps in prices, except for a few luxury Davis Square condos that took a hit on sales price.

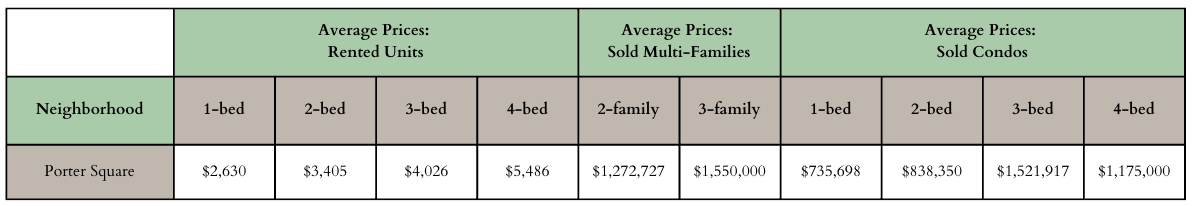

Porter Square

For the most part, rents increased year over year in the Somerville section of Porter Square: 1-beds were up $140/mo, 2-beds were up $200/mo, 3-beds were down about $90/mo, and 4-beds were up about $500/mo.

Multi-family sales prices plummeted in the Somerville section of Porter Square: 2-families were down about $250k and 3-family sales were down about $400k. The high interest rate environment has resulted in more investors hitting the sidelines or getting pickier on price, particularly in the more mature real estate markets where sellers expect a premium. Trump’s policies have impacted international students attending Harvard and MIT and a good chunk of the renter demographics around Porter fall in this bucket, so unfortunately we are seeing a significant impact on some investors willingness to enter the market.

We saw mixed information when it comes to condo sales in Porter Square. 1-beds were up about $140k, driven by newer buildings/luxury condos. 2-beds were down about $40k. 3-beds were up about $130k. 4-beds had a low price point this year but that’s because most of the sales were not new, gut renovations but instead a lot of smaller investor grade 4-beds driving down price to an average of just $1.175M.

The Porter Square rental market remains strong, but the multi-family market in Porter Square no question took a hit this past year. I expect to see prices to bump back up in 2026 for multi-families and I expect rents to remain about even or slightly increase in 2026.

I expect to see solid performance for Porter Square condo sales but the game has changed - if you don’t properly prepare and stage your condo, the chances of a disappointing sales price or long days on market will go up substantially.

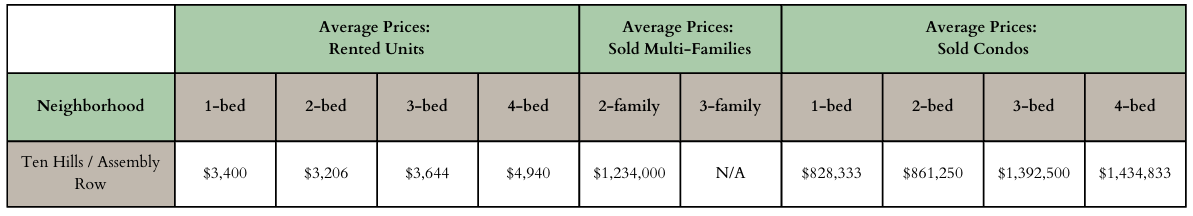

Ten Hills / Assembly Row

The data for the Ten Hills/Assembly Row area is a little hard to parse, mainly because the rental and sales inventory is vastly different in Ten Hills (generally a mix of older 1900s buildings or gut renovated luxury condos) vs Assembly Row (full amenity elevator building with hundreds of units).

So while on the surface we are seeing 1-bed rental increases of about $800/mo, that is a bit misleading since if you were to remove units in Assembly Row we would see close to a break even year strictly in Ten Hills. 2-beds remained flat year over year, and 3-beds were up about $200/mo. 4-beds were up about $1000/mo, but that is because new luxury condos in Ten Hills were rented, driving up the rental price substantially for this part of Somerville.

We saw really solid 2-family growth in Ten Hills, up $175k year over year. This is an area I love to target for my buyer clients because I expect steady growth for years to come. There are no 3-families in Ten Hills as far as I know.

As I mentioned in the beginning of this write-up, a number of Assembly Row units sold this year which drove up the condo sold prices for this section of Somerville across the board. 1-beds were up about $300k, 2-beds were up $26k, 3-beds were up $460k, and 4-beds were up about $250k. Between the developers who have come in and redeveloped 2-families in Ten Hills and the many units sold at Assembly, we are seeing seriously rising condo prices in this section of Somerville.

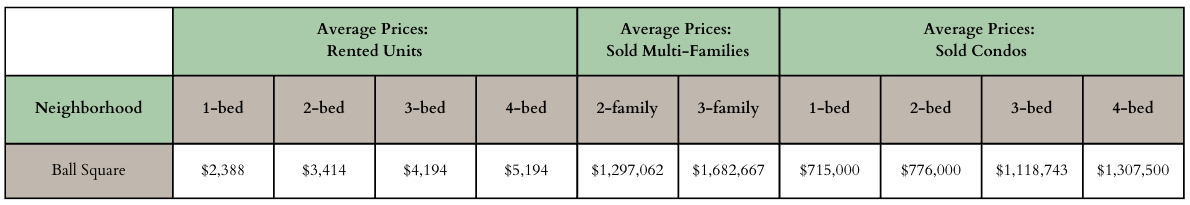

Ball Square

I mentioned in last years report that I felt Ball Square was too hot/overpriced and I expected a cool down to happen at some point and it seems like that cool down is officially here.

On the rental side of things, 1-beds were down about $370/mo, 2-beds were even, 3-beds were down $100/mo, and 4-beds were down about $100/mo.

We saw a dramatic drop-off in Ball Square 2-family sold prices, down about $360k year over year. 3-families remained even compared to 2024 numbers.

For condo sales, the only silver lining in Ball Square was 1-beds, which saw an increase of $65k, but 2-beds (down ~$150k), 3-beds (down ~$300k) and 4-beds (down ~$150k) all took significant hits compared to 2024 numbers.

I would not be surprised if we see even or slightly lower numbers next year as well. Ball Square became extremely hot with the new green line T stop and the new numbers were in line with more mature sections of Somerville like Davis and Porter Squares, my feeling was at some point we would see numbers come back down to earth and it seems that is happening right now. I expect to see more of a correction over the next few years but Ball Square is still a great place to buy and hold, particularly if you plan to hold on for at least 5+ years.

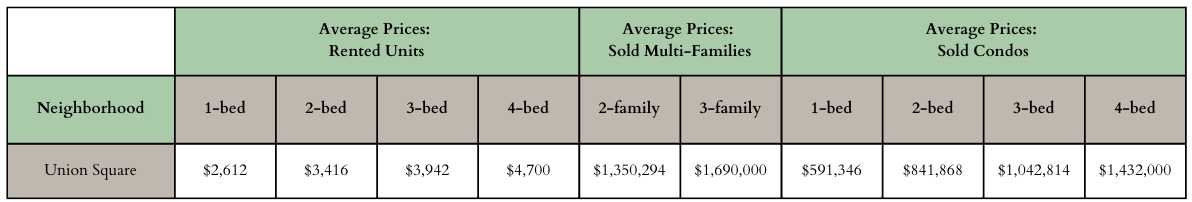

Union Square

The smaller bed count rental units in Union Square stayed relatively even from 2024 numbers - 1-beds were down $10/mo and 2-beds were up slightly by ~$80/mo. 3-beds saw a healthy increase, up about $300/mo, and 4-beds took a hit, down $200/mo. Overall I continue to believe in Union Square as a place to invest and live in and expect over the next 5 years we will see steady growth in rental and sales prices.

We did see increases in multi-family sales numbers in Union Square - 2-families were up $25k from last year and 3-families were up about $100k.

The condo market in Union Square has cooled compared to the last few years. 1-beds are down about $90k and 2-beds are down about $130k. 3-beds are also down from last years number, about $130k lower than 2024 numbers. Average sold price for a 4-bed condo in Union Square was $1.432M, definitely lower than what I saw a few years ago when rates were in the 5s.

There are some natural bumps along the road in Union Square but as a long time owner, I would expect to see excellent long-term returns whether you are renting or owner occupying your property.

If you want to SUBSCRIBE to future newsletters not published on my blog for Camberville/Medford hyper local real estate news/analysis, sign-up here: https://cambridge-sage.kit.com/472d081e75

And that wraps up the latest data and my analysis on Somerville! If you want to discuss further, give me a ring/text at 617-833-7457 or shoot me an email at Sage@CambridgeSage.com.