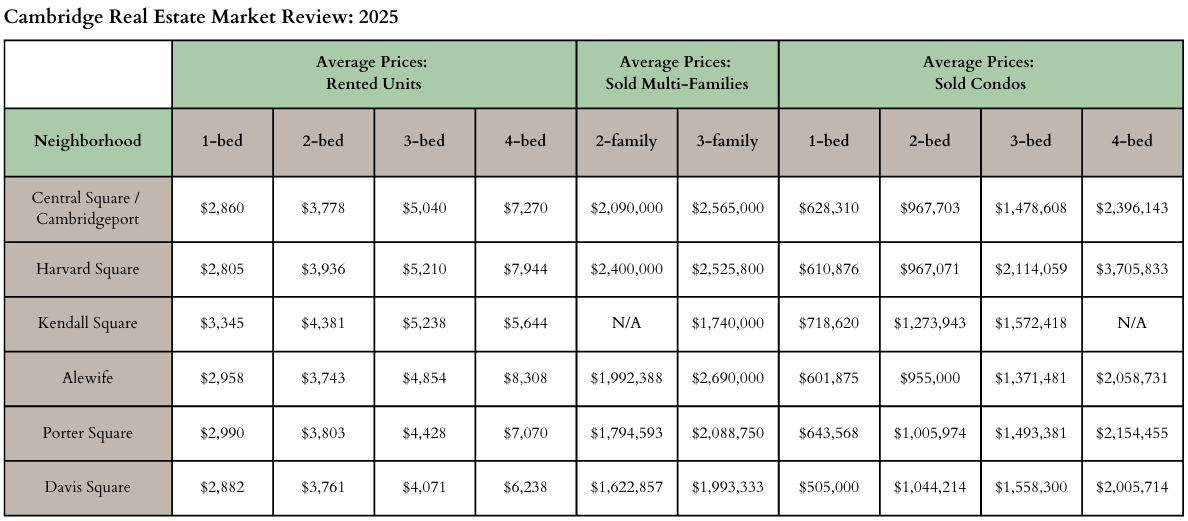

Cambridge Real Estate Market Review: 2025

Introduction

As we look back on 2025, I am excited to share with you a complete breakdown of Cambridge neighborhood data for:

Average rental prices for 1, 2, 3, and 4-bedroom units

Average sold prices for 2 and 3-family properties

Average sold prices for 1, 2, 3, and 4-bedroom condos

If you want to skip the high-level data summary and jump RIGHT to details on your neighborhood only, click on one of the links below:

Central Square / Cambridgeport ✦ Harvard Square ✦ Kendall Square ✦ Alewife ✦ Porter Square ✦ Davis Square

Data Summary

This data could be valuable to you in several cases:

If you’re an investor or thinking about becoming an investor, these data points will help you figure out on a high-level what you can roughly expect for rental rates in various neighborhoods based on bedroom count for rentals as well as condos. You’ll also have a better understanding of what you’ll need to pay to purchase multi-family properties.

If you are a primary buyer looking for a condo, you should have a pretty good idea of what neighborhoods are likely to be affordable for you and which ones are likely out of budget or pushing it.

When you see fields that are marked “N/A” there were not enough data points for that specific category. Generally this means there are not a lot of sales or rented units for that specific property type. This is actually valuable information, because if you are looking in a category that is marked N/A as a primary buyer, it signals it may not be easy to find or what you’re looking for may not exist at all - in other words, there’s a good chance you’ll need to adjust your search.

A few quick caveats on the data:

The data is from MLSpin. Understand that there are many rentals that happen off MLS and are not covered in this data set.

No off-market data is included.

Some fields have N/A. This means there was no or insufficient data for this particular neighborhood/property type.

All neighborhoods boundaries were determined to the best of my ability, based on my personal opinion of the radius I consider to be relevant to a particular neighborhood

After looking at this data, are you concerned your rental is underpriced or overpriced? Are you curious about selling or investing in multi-families? Are you thinking of buying a condo and feel overwhelmed? Please give me a ring to discuss anytime at 617-833-7457. Read on for my thoughts and analysis.

If you want to SUBSCRIBE to future newsletters not published on my blog for Camberville/Medford hyper local real estate news/analysis, sign-up here: https://cambridge-sage.kit.com/472d081e75

Neighborhood Deep Dive

Continue reading for my thoughts on each neighborhood. If you don’t want to scroll to find the neighborhood you’re interested in, just click on one of the links below.

Central Square / Cambridgeport ✦ Harvard Square ✦ Kendall Square ✦ Alewife ✦ Porter Square ✦ Davis Square

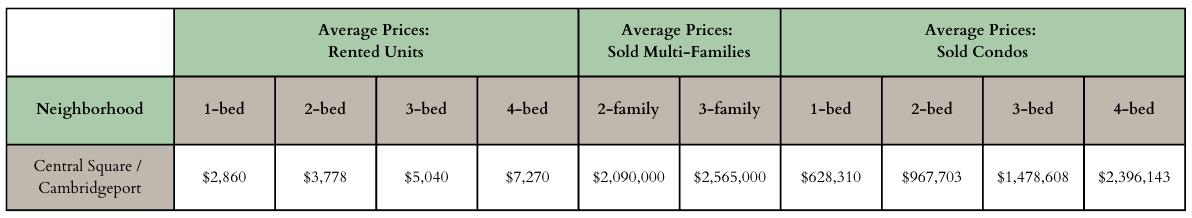

Central Square / Cambridgeport

Central Square / Cambridgeport is consistently one of the most in-demand sections of Cambridge. The data shows a bit of a mixed bag compared to 2024’s numbers. 1-beds were up $61/mo (from $2799 to $2860), 2-beds were up $41/mo (from $3,737 to $3778), 3-beds were up $146/mo (from $4,894 to $5,040) and 4-beds were up $1,084/mo (from $6,186 to $7,270).

Multi-families also continued to grow in value year-over-year in Central Square/Cambridgeport. 2-family sold prices went up well over $300k, from mid $1.7M average sale price in 2024 to almost $2.1M in 2025. 3-family sold prices also saw large gains, up almost $600k from around $2M last year to around $2.5M this year.

Condo sold prices saw a slowdown in Central Square which is exactly what I experienced on the ground in 2025. 1-beds were down about $30k year over year from $659k in 2024 to $628k in 2025. 2-beds were down about $50k year over year, down to an average sold price of $967k. Average 3-bed sold prices saw a major dip, going down $200k from upper $1.6s to upper $1.4s year over year. 4-bed sold prices were the one bit of silver lining, as they continued to climb in value, increasing about $100k year over year.

My key takeaways - the Central Sq/Cambridgeport rental market remained strong despite a broader decrease in rental demand throughout Cambridge in 2025. The multi-family market also remained strong with most multi-families still having great sold price and short days on market. Condo prices took a hit - as a lot of first time home buyers were weary of high interest rates and more international buyers left the market.

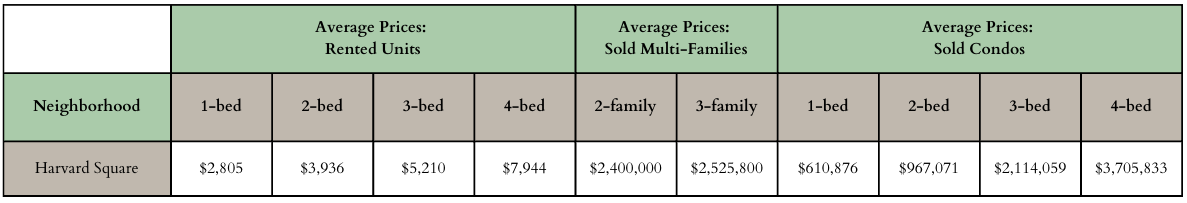

Harvard Square

Harvard Square took a real hit when it comes to rental market numbers this year, driven by Trump’s attacks on Harvard. While rents were up for 1-beds (up about $70/mo), 2-beds were down y-o-y over $500/mo, 3-beds were down about $280/mo, and 4-beds were down over $1,000/mo.

I didn’t have enough data points for multis in Harvard Sq in 2024, but for 2025 we saw 2 and 3 families close to Harvard Square landing in the mid $2Ms.

The condo market in Harvard Square was a bit of a mixed bag. Smaller condos took a hit - 1-beds were down slightly about $20k y-o-y and 2-beds dropped off in a major way down over $300k from last year's numbers. Larger, luxury condos saw major gains though - 3-beds were up over $200k from 2024 numbers and the average sold price for a 4-bed close to Harvard Square went a tick over $3.7M.

There is a high likelihood if you have a rental unit that is driven by the Harvard demo you took a hit this year. I’m hopeful that things will improve this year but only time will tell. If you are lucky to own a multi-family close to Harvard Square you saw growth and I anticipate values to continue to increase in the most prime market in all of Cambridge.

And if you own a condo it’s going to really depend on how big that condo is and where it is located - smaller 1 bed and 2 beds are feeling the squeeze right now (particularly in large 25+ unit buildings), but larger 3-bed plus condos in smaller buildings seem to be performing well. I will also add that while it’s early, initial buyer interest in January appears strong so I would not be surprised to see an uptick this spring in condo sales numbers across the board in Cambridge.

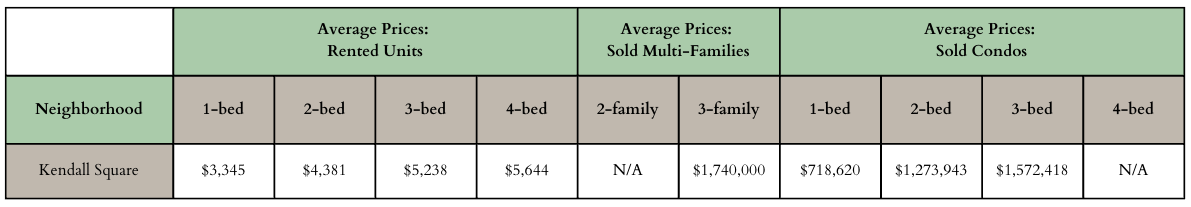

Kendall Square

Kendall Square rental numbers had a relatively even year, which is a bit surprising considering the biotech sector has taken a hit over the past 12 months. 1-bed rentals remained even year over year, 2-beds were down about $130/mo year over year, but 3-beds were up about $300/mo.

We didn’t have a lot of data for 2-family sales in Kendall Square in 2025 but 3-family sold prices are down about $100k year over year. Not surprising considering the softening of the biotech sector (who often make up a decent chunk of East Cambridge investors).

When it comes to condo sales we are seeing a bit of a mixed outcome in Kendall Square. 1-beds are down almost $100k, which again makes sense when you think about all the junior first time home buyers that have been knocked out of the market in the biotech sector. 2-beds on the other hand went up about $130k year over year - I attribute this to the data being a bit skewed with a few luxury 2-bed condos selling at very high prices. 3-beds also were down quite a bit, down over $300k year over year.

Overall Kendall Square has definitely taken a hit and it’s a mixture of less biotech employees looking for housing or having the financials to buy, plus less international renters and buyers entering the market due to Trump’s policies. There could be some good buying opportunities in Kendall Square in 2026 OR if rates come down another ½ point or more in the spring, I could see a world where prices actually increase around Kendall Square as first time home buyers take advantage of competitive prices compared to the rest of the Cambridge real estate market.

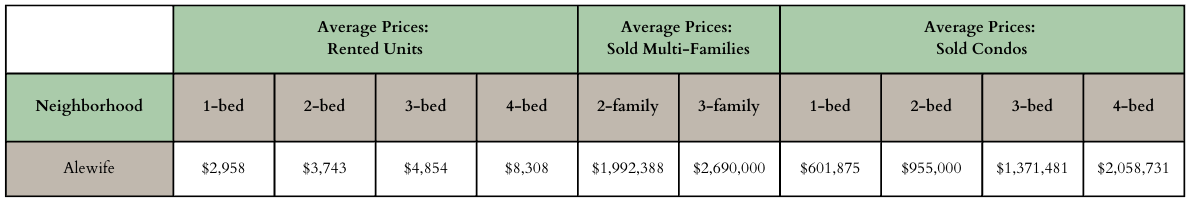

Alewife

In Alewife, things stayed similar to last year overall when it comes to rentals. 1-beds were down about $50/mo year over year, 2-beds were down $15/mo year over year, and 3-beds were up about $200/mo - mostly driven by newer luxury condos. Overall I saw a flat market in Alewife - no big changes in either direction when it comes to the rental side of things.

We saw a few multi-family sales in Alewife at very high numbers - 2-families averaged almost $2M this year and 3-families averaged a tick under $2.7M. We didn’t have enough data in 2024 - there just isn’t that much multi-family inventory in this section of Cambridge that comes on each year.

A number of luxury condos came on the market this year around Alewife and as a result we see what on the surface looks like massive gains in this section of Cambridge. In reality I believe the data is a bit skewed because last years data points were mostly older Cambridge condos that were slightly updated whereas this year many sales were complete gut renovations or newer buildings. 1-beds were up about $30k, 2-beds were up over $150k, 3-beds were averaging around $1.375M, while 4-bed condos close to Alewife came in at around $2.05M.

Overall the Alewife section of Cambridge tends to be more affordable whether you are looking to rent or buy, but there are some indications in this data that demand is increasing here and that prices in and around Alewife are catching up to the hotter areas within Cambridge. If you own property around Alewife, it may be worth understanding how much your property has appreciated in the past 12 months (just reply to this email with your address and I can get you a custom report within a few days).

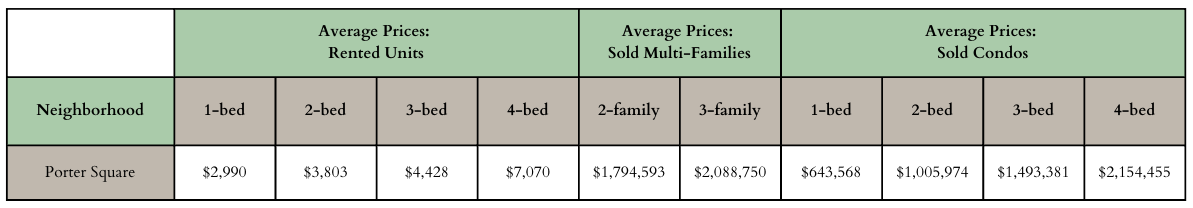

Porter Square

Porter Square’s performance this past year was mixed compared to last years numbers. On the rental side of things, 1-beds were up about $140/mo, 2-beds were down about $140/mo, 3-beds were down about $250/mo, and 4-beds were up slightly about $100/mo.

2-family data from last year in Porter Square included a few really nice, large 2-families that pumped prices, so I would take last year’s 2-family data point with a grain of salt ($2.368M). This year, the average 2-family in Porter Square sold for right around $1.8M which is in line with what I’ve seen the past few years. 3-family numbers increased about $240k year over year - 3-families throughout Cambridge remain strong and with rates likely to drop a bit next year I would not be surprised to see further increases when it comes to 3-family sold numbers in Porter Square and throughout the Cambridge multi-family market.

The condo market remained relatively flat across the board in Porter: 1-bed condos were up $28k from last year, but 2-beds were down about $30k, 3-beds were up about $40k and 4-beds up about $25k.

The Cambridge side of Porter Square was an area I had a tough time break downing for 2025. There were pockets of rentals that took serious hits and some condos went much lower than ever would have expected. On the flip side, I saw other condos and rentals perform extremely well and close quickly with excellent prices. It seemed to me that units with funky things going on - weird tight layouts, ultra pink bathrooms, low ceilings, busy streets performed not so well in general in Porter Square and those that checked the boxes buyers or renters generally look for out-performed the market.

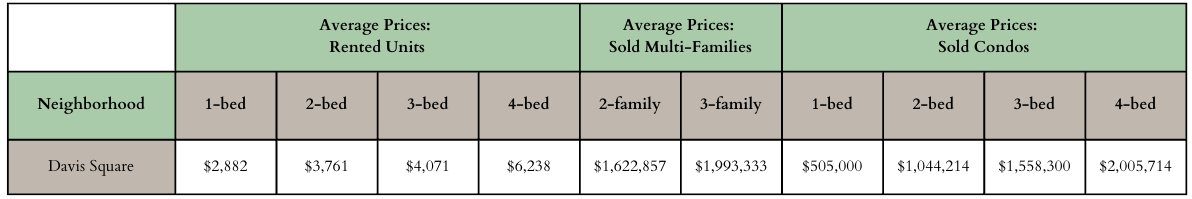

Davis Square

Davis Square (on the Cambridge side) definitely saw a softening compared to last year’s numbers. While 1-bed rentals were up about $170/mo, 2-beds were down about $175/mo and 3-beds were down about $370/mo. And 4-beds were at $6,238/mo, making it second lowest in rents for 4-beds for all areas around Cambridge I look at. In past years, Davis Square had amongst the best numbers when it comes to larger rental units, so there is no question we are seeing a change here.

While we didn’t have the data points for multi-family sales last year, this year we saw 2-families come in around $1.6M and 3-families come in around $2M. These numbers are totally in alignment with what I have seen in previous years, so while we are seeing some hits to rental numbers in the Cambridge section of Davis Square, so far multi-family sold data remains strong here.

Davis Square 1-bed condo sales were the lowest in 2025 throughout Cambridge, coming in at $505k - all other 1-bed sales around Cambridge started north of $600k. Part of this is because the data is thinner here (there were very few 1-bed condo sales on the Cambridge side of Davis Square). But I do wonder if Davis Square is seeing a price regression and it’s something to watch in the spring of 2026.

2-bed condos in Davis Square were down slightly by $12k year over year, but 3-beds were up about $200k from last year and 4-beds were up about $30k.

The story in Davis Square is the same story I saw throughout all of Cambridge - rental numbers overall feel shakier compared to previous years. Multi-family sales continue to perform well. Smaller condos (1 or 2-beds) are not seeing the consistent price growth we’ve seen in previous years, but larger 3+ beds continue for the most part to perform well. I believe this is because the larger units attract high income earners who are willing to pay a premium despite economic conditions feeling a bit more uncertain, whereas the smaller units attract first time home buyers that are simply not in a position to buy right now in many cases.

If you want to read the data for the Somerville section of Davis Square, please click here.

If you want to SUBSCRIBE to future newsletters not published on my blog for Camberville/Medford hyper local real estate news/analysis, sign-up here: https://cambridge-sage.kit.com/472d081e75

And that wraps up the latest data and my analysis on Cambridge! If you want to discuss further, give me a ring/text at 617-833-7457 or shoot me an email at Sage@CambridgeSage.com.